Get more! Sign up for PLANSPONSOR newsletters.

Uncovering Hidden Risks in Fixed-Income Target-Date Fund Allocations

Brett Wander and Jake Gilliam of Charles Schwab say plan sponsors should consider re-examining their TDF fixed-income allocations, with an eye toward identifying potential heightened downside exposure risk.

Most plan sponsors would agree that the primary goal of the fixed-income strategy inside a target-date fund (TDF) is to help protect assets against market volatility, particularly as participants near retirement. But whether plan sponsors realize it or not, that effort may have been compromised in some TDFs over the last several years.

In an effort to combat years of incredibly low interest rates, some active fixed-income strategies held in TDFs may have taken on additional risk within their portfolios. As a result, some TDF fixed-income exposures risk the potential of behaving more like equities than bonds, today. And the timing couldn’t be worse—an elevation in fixed-income risk can jeopardize accumulations when participants are at their most vulnerable, as they near retirement.

Given that, plan sponsors should consider re-examining their TDF fixed-income allocations, with an eye toward identifying potential heightened downside exposure risk. Below are three things to look out for, along with some guidance regarding how, potentially, to respond.

Additional Risk-Taking

Many TDFs rely exclusively on active fixed-income strategies, which seek to capture incremental return advantages in higher-yielding credit segments. At the same time, almost a decade of generally strong credit markets has led some to feel a false sense of security about exactly how much additional risk this “stretching for yield” potentially entails.

As an illustration, consider how the goal posts have moved over the last several years for fixed income managers aiming to secure a 5% yield. In 2007, that could be done with virtually no credit risk using U.S. Treasury securities. Two years later, investors would have needed to invest in U.S. corporate investment-grade bonds to achieve that same coupon level. Today, a similar 5% coupon would require venturing into Ba-rated U.S. high-yield bonds, representing a significant elevation in credit risk relative to U.S. Treasurys.

Extra Risk Can Mean Fixed Income Behaves More Like Equities

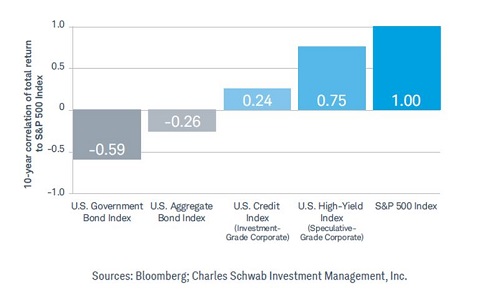

Greater exposure to higher-yielding corporate bonds can notably dampen a fixed-income allocation’s diversification benefits to equity investments. Consider the historically negative return correlation of the Bloomberg Barclays Capital U.S. Aggregate Bond Index to the Standard & Poor’s (S&P) 500 Index, which has allowed the bond index to perform as an effective cushion against stock market downturns.

Investment-grade and high-yield corporate credits have failed to offer the same degree of protective attributes, instead moving more in tandem with stocks. This greater correlation to what is often the riskiest part of participants’ retirement savings may subject them to greater downside exposure just when they need the most protection—when equity markets turn volatile.

Elevated Risk Can Jeopardize Accumulations When Participants Are Most Vulnerable

A core premise behind TDF design is that glide paths become increasingly conservative as participants approach and enter retirement. Accordingly, average TDF equity allocations fall steadily, typically to less than 50%, as participants near their target date, though the specifics can differ by strategy.

This means average TDF fixed-income allocations are at their greatest as account balances tend to reach their highest levels. Plan sponsors should carefully consider how much downside risk they are willing to accept in this key asset class, given the generally significant size of its allocation in later working years and the fact that older participants may not have the time to recoup any outsized portfolio losses before they need to begin drawing down assets.Know What’s in Your TDFs and Consider a Blended Approach

Evaluating a fixed-income strategy’s potential risks is a matter of “knowing what you own.” To help identify downside exposure, plan sponsors and their advisers can ask:

- What is the strategy’s yield, and how is it being generated?

- What is the strategy’s credit exposure across securities, and how does this differ from the benchmark?

- How have these attributes changed across different bond market cycles?

- What is the potential risk to participants, particularly those nearing or in retirement?

Plan sponsors and advisers may also find it useful to review if and how a fixed-income strategy’s risk exposure may evolve at various points along the glide path.

For example, although active security selection and sector weightings may seek to deliver stronger returns long term, this potential upside comes at the cost of higher risk. The optimized solution may be a blended fixed-income allocation that incorporates both passive and active strategies.

Utilizing both of these strategies can provide closer alignment in appropriate fixed-income exposures to changing risk/reward profiles as participants age, allowing for greater active risk-taking and return potential in early saving years, with tighter volatility and downside controls as retirement nears. The net result can be a more balanced investment path across both strong and difficult market cycles, helping participants protect the assets they have worked so hard to accumulate.

By Brett Wander, chief investment officer, Charles Schwab Investment Management, Inc., and Jake Gilliam, senior multi-asset class portfolio strategist, Charles Schwab & Co., Inc.

NOTE: This feature is to provide general information only, does not constitute legal advice, and cannot be used or substituted for legal or tax advice. Statements by the authors do not necessarily reflect the stance of Strategic Insight or its affiliates.You Might Also Like:

Nuveen Names James Nelson as Global Head of Public Product

Asset-Diversified TDFs Produce Better Retirement Results When Exposed to Alts

Retirement Industry People Moves

« One-Third of Alternative Investment Assets in Pension Funds