For more stories like this, sign up for the PLANSPONSOR NEWSDash daily newsletter.

Best Practices

Retirement plan oversight is a challenging task for any plan sponsor. For 403(b) plan sponsors, many of whom use multiple vendors, the responsibility may be especially challenging from an administrative side. For all plan fiduciaries, regardless of the retirement plan type or size, one critical function is to benchmark the retirement plan periodically. Benchmarking can take many different forms but, no matter how it is performed, all benchmarking has the same end goal—to help plan sponsors understand what people in their like industry and plan size are doing and ensure their retirement program offering is competitive. Recently, PLANSPONSOR and Eric Wietsma, Senior Vice President of Sales and Workplace Education for MassMutual’s Retirement Services Division, discussed best practices in benchmarking for 403(b) plan sponsors.

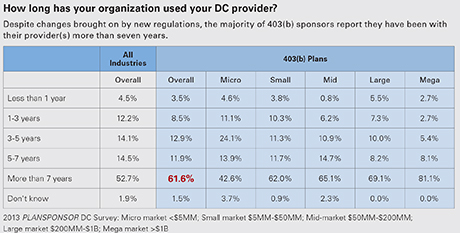

PS: The industry has been spending a lot of time talking about benchmarking plans recently. What do you recommend to plan sponsors when they ask how frequently they should be reviewing their providers?

Wietsma: If, as a plan sponsor, you haven’t gone through a normal due diligence process with a knowledgeable adviser or consultant who is well-equipped to walk you through benchmarking of your plan—meaning what your plan currently offers versus what is available today in the 403(b) market—that is something that absolutely needs to happen. Typically, such a review should happen every three years. Even after a plan achieves a modernized state, at the very least, plan sponsors should have a request for information through a third-party adviser or consultant to benchmark plan fees and plan funds to ensure fiduciary status is in good shape. One advantage I see for nonprofits is that, in general, nonprofit retirement plan sponsors are extremely committed to employees and participants, and there are huge opportunities for sponsors to ensure that all of the employees are participating in the retirement plan benefit.

PS: Now that we’ve established how frequently plans should be reviewed, let’s talk about what plan sponsors should be reviewing. What should they be benchmarking?

Wietsma: When I look at the research statistics1—specifically around the micro market—the answer is approximately 40% are evaluating their DC provider annually. It seems there might be some misinterpretation of what a formal evaluation looks like, so let’s cover that.

Annually evaluating your plan from the product side is not

really a fiduciary evaluation. That’s really just an evaluation of the product

you’re currently offering. So, in discussing types of evaluations of providers

and the solutions, we’re really talking much more about a true fiduciary

process. It would happen every three years and is typically done by a competent

third party that is not associated directly with a product. Probably the single

most important thing I would stress

to every plan sponsor—it is really critical that the process be

documented, and that you can prove to the Department of Labor and to your

participants that a thorough due diligence process was conducted at least once

every three years.

Another distinction I would make is regarding the recordkeeper. The evaluation is more than just the recordkeeper. The due diligence process and subsequent documentation should demonstrate that you’re evaluating the recordkeeping, the plan sponsor services, and the participant’s services. The good news is that, due to current disclosure requirements, it should be much easier for you, the sponsor, to obtain real data specific to your plan.

On the investment side, I would say it’s absolutely critical that you are at least reviewing investments quarterly and then conducting a thorough third-party deep dive into the investment options you’re offering participants at least annually.

PS: Research has shown that 403(b) plans offer many more investment options than the overall market—32 on average. What do you think about this statistic?

Wietsma: I believe that, on the nonprofit side, the number of choices actually offered to a participant is crippling. Studies have proven that, believe it or not, once you go above seven investment choices, there is actually a decrease in asset diversification among participants.

Plan sponsors, providers, consultants and advisers need to get the number of investments down to a manageable number for participants. That probably looks like a target-date series coupled with a good, solid fund in each asset class. So, you’re really going from where we are today to a fund lineup that would have somewhere around 10 to 12 options if you considered a target-date series one fund.

For a nonprofit organization that has multiple providers—say you have four different providers in your organization—and you’re looking at backend loads and consolidation efforts there, you’re going to need a good adviser. That adviser should have the expertise to navigate the nonprofit arena to get to a single provider, if that’s what you choose to do, or, to enlist the help of someone who can aggregate so that the plan sponsors can do what they need to do.

PS: I think we all understand that, from a regulatory standpoint, fees and expenses are going to be an absolutely crucial part of the due diligence process from a fiduciary regard. However, more than 28% of the 403(b) plans, overall, and even a higher portion of plans with less than $50 million in assets, don’t know their fund expenses. What can plan sponsors do to better understand their fees?

Wietsma: In looking at the micro, small and even mid-market plan data, many sponsors think their expenses are less than 75 basis points for their investment options. In my mind, they actually fit into the “unsure” column. So, in reality, probably well more than 50% of nonprofit employers are somewhat in the dark on the true expenses of their investments, whether they are appropriate or not.

So really, this indicates that plan sponsors are uncomfortable—and I don’t mean that in a negative way. It’s a great opportunity for plan sponsors to reach out to a third party for help in better understanding and benchmarking the plan and investment fees; to understand the difference between commissions, what’s charged for recordkeeping, what’s charged for plan sponsor expenses, what’s charged for participant expenses—basically, someone that can ensure that you really understand the expenses in your plan.

I think 408(b)2 is good, but it’s not the total answer. Plan sponsors still have to be a bit more investigative when it comes to understanding all the fees within a retirement plan.

Once again, these are the things that an expert retirement plan adviser who is very familiar with retirement plan investments and contracts can identify and explain. It’s tough for plan sponsors who are trying to keep a nonprofit organization clicking on a day-to-day basis.

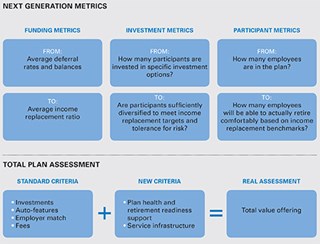

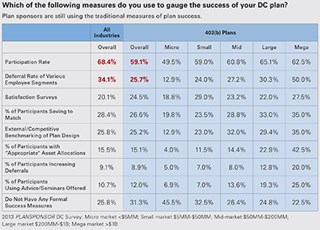

PS: When you ask plan sponsors how they measure plan success, most say they look at participation rates. However, many, more than one quarter, have no success measures. How do you think plan sponsors, specifically 403(b) sponsors, should be evaluating plan success? What metric should they use and how should they go about the business of understanding the effectiveness of their plan design?

Wietsma: I think the big challenge here is to change a plan sponsor’s mindset from “We’re going to do a lot of different activities to increase participation, increase deferral rates or utilize asset allocation funds” to focus more on the “what’s the outcome in terms of participant readiness?”

A sponsor, together with an expert plan adviser, should demand of the provider, “What does the outcome look like?” So, based on what participants are doing today and based on adapting plan design to leverage behavioral finance theories—for example, what drives participant action, targeting campaigns to the population, and delivering the right participant education, what is the outcome that we’re going to have?

There is so much room for plan sponsors and advisers to apply the research and plan design techniques to help improve outcomes. How are you using auto-enrollment? How are you using auto-deferral increase? Did you apply these factors only to new employees or did you go back and apply them to your existing participants?

For example, what we’re seeing coming out of the research now is that you can go up to a 6% or higher default rate using auto-enrollment with very little impact on the percentage of employees who will opt out. On top of automatic enrollment, sponsors should consider an auto-deferral increase design, so that, annually, a participant receives a notice beforehand, but once a year their contribution can be kicked up by 1% or 2%.

As the retirement plan becomes more of a workplace benefit and more of the responsibility for income replacement falls on the participant, it’s just critical to use these kinds of techniques to help people get where they need to be. Sponsors and advisers can use the statistics and the behavioral finance research we now have to look at plan design as a way to get participants better prepared to replace sufficient income in retirement.

We are showing the sponsor and the participant how their actions today can help create a better result from an income replacement standpoint. In fact, I would suggest that success for a plan sponsor is really going to be, “What percentage of your employees could retire at age 67 with 75% of their income replaced per year throughout their retirement?”

As employers struggle harder and harder to keep a defined benefit plan or a money purchase plan, as an industry we have to do a lot more work at a plan-design level and also work directly with participants to help them take the necessary actions. MassMutual’s new participant statement is designed so that participants literally will see their income replacement ratio. This is supported by the participant website where we have a tool that shows participants two very basic changes they can make to increase their likelihood of reaching a 75% income replacement ratio by age 67.

As an industry, we are collaborating with some great behavioral finance people and, at MassMutual, we are using industry research along with our own proprietary data to help improve the outcome for plans and participants.

PS: This movement toward results sounds more focused on plan design. As many plan sponsors know, our industry has struggled long and unsuccessfully with participant education. Is participant education, particularly as it relates to investments, now just simply not worth the attention that we once spent on it when you look at the way you are benchmarking plans now?

Wietsma: We’ve learned over 20 years or more of studying participant behavior that there are ways to overcome inaction. For example, instead of opting in, we provide participants an opportunity to opt out and we’ve found that very few of them do.

Candidly, what we’re striving for is to celebrate great results with participants instead of asking them to make changes that, based on normal human apathy, they’re never going to get around to doing. We have to be intelligent enough as an industry and help sponsors leverage things that work—and that are in the best interest of the participant—while we explain to the participant how well it worked for them. So that’s kind of how I look at it. It’s not an either/or. It’s probably instead of 100% education; it’s probably 70% plan design and 30% education skewed toward participant action based on behavioral finance.

PS: If benchmarking plan success goes beyond just ensuring your program is competitive, where can plan sponsors get a sense of whether they are achieving their individual plan goals?

Wietsma: MassMutual has a plan health report that actually can measure where a plan started and then—based on the changes the advisers and sponsors implemented—what changes occurred on that income replacement path. It’s based on data, so we need to get the right payroll data so that we can measure the change. However, that report is live and we already have nonprofit plan sponsors on our platform using it successfully.

PS: You’ve mentioned third-party help a number of times; why do you think a plan sponsor should consider getting outside help, instead of trying to do this on his/her own?

Wietsma: Relating to everything we talked about, the analogy I use with regard to a qualified adviser is a personal trainer. When I look at the nonprofit organizations that have made good progress and those that have stopped, often the difference is which “personal trainer” they chose—or which adviser they picked.

One thing for plan sponsors to note, however, is that they definitely want to work with an adviser who has specific experience in nonprofit. Unwinding the past can be complicated and it’s critical for the adviser you’re working with to have experience.

Across the different segments of the nonprofit market (hospital, healthcare service, charity, religious organization, private higher education and private K-12, public higher education and public K-12), each is at a different stage in the evolution. For the most part, hospitals and health-care services are leading the pack in modernization, while public higher education and K-12 are lagging due to legacy issues.

Plan sponsors have many options for help. Over the last couple of years, many advisers that historically had worked solely with corporations realized that they could help nonprofit organizations make this progression. Many of these advisers now have a wealth of experience in helping plan fiduciaries to unwind the past and modernize their plans. So, there’s a good stable of new advisers who had, historically, not worked in the nonprofit space but who are now applying the same level of due diligence to the nonprofit market. Today, plan sponsors looking for assistance have a wealth of good options—the key being to make sure the adviser they select has experience with a plan situation like their own.

Each sector should strive to improve the products and services for their employees—it will take time but, with the right collaboration and expertise from nonprofit experts, improving the retirement readiness of your employee population is attainable.