Industry Snapshot

457 Plans

Although 457 plans operate similarly to more traditional defined contribution (DC) plans, they are also thought to be less accessible and more complex. Governmental 457(b) plans, which can resemble 401(k)s, are the largest subset of these plans and cover around 7 million state and local government employees, while nongovernmental 457 plans cover only 250,000 participants who must be highly compensated employees (HCEs). In both cases, the 457 plan is often supplementary to other retirement plan offerings—i.e., pensions or other eligible DC plans.

On the surface, 457s may be less successful than other DC plans at capturing participant savings, as the $51,520 average account balance is roughly 35% lower than the average saved in 401(k) plans—$79,720. However, such measures fail to account for participant savings in other accessible retirement plans and the limitations many public sector 457 plans face in offering features such as automatic enrollment and automatic escalation.

The specialized rules governing 457 plans mean providers can differentiate themselves based on the quality of participant servicing strategies, including successful enrollment materials, effective communication/education campaigns and financial wellness programs capable of guiding participants to improved outcomes. Retiree services can also be important, given some public sector employees are ineligible for Social Security. —BOK

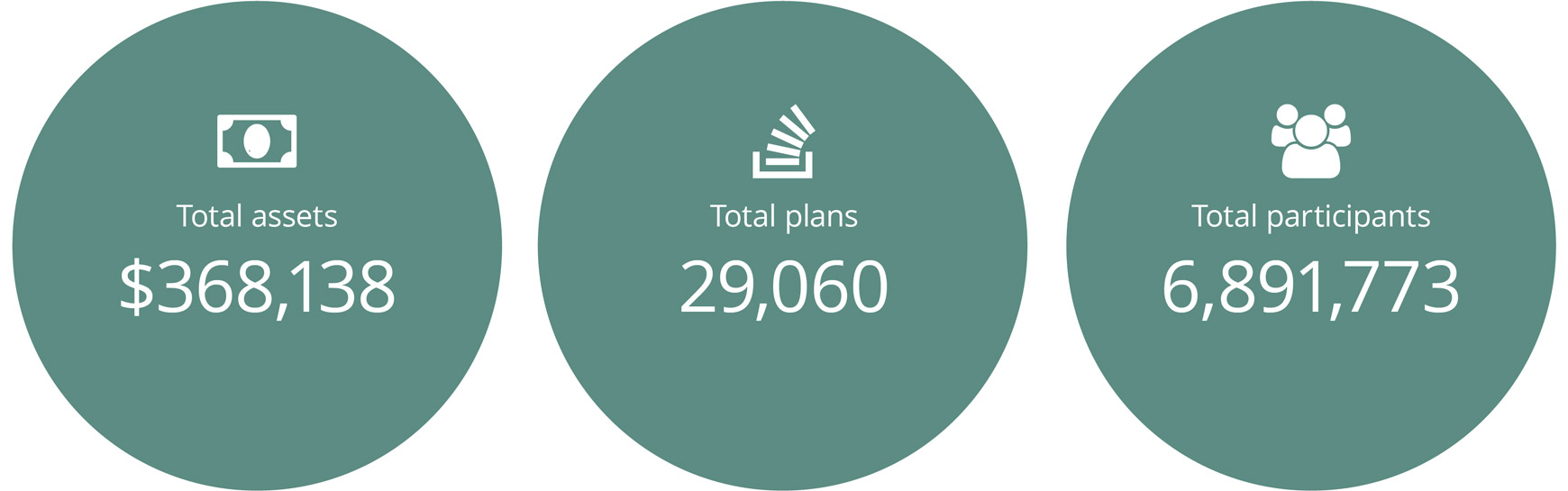

Total Governmental 457 Assets, Plans and Participants

| Plan Size | Assets ($mm)* | Plans* | Participants* |

|---|---|---|---|

| <$25mm | $46,290 | 27,849 |

1,418,574 |

| $25mm – $100mm | $36,136 | 831 | 627,485 |

| >$100mm – $500mm | $58,916 | 289 |

1,501,844 |

| >$500mm | $226,796 | 91 | 3,343,870 |

| *Not all providers report complete data; therefore, data segmented by plan size will not equal the corresponding overall total. | |||