Never miss a story — sign up for PLANSPONSOR newsletters to keep up on the latest retirement plan benefits news.

Back to Basics

2014 Pyramis Global Advisors Institutional Investor Survey

RESPONDENTS: Key Stats*

– 191 corporate respondents

– 71 public respondents

– $1.9TUSD total assets under management

*An additional 48 U.S. responses were gathered from multi-employer pensions, insurance companies and non-profit organizations.

In response to the expectations of a low return/high volatility environment, institutional portfolios have become overly complex. Now that markets have turned around, investors are confident about meeting their objectives—and are left wondering whether these complicated investments are worth the risks and the fees charged.

With favorable markets and lower-than-average volatility since 2012, institutional investors are now focused on closing funding gaps. Contrary to other parts of the world, where preservation of assets is paramount, U.S. pension executives are aiming for growth in 2014, according to the bi-annual Global Institutional Investor Survey by Pyramis Global Advisors.

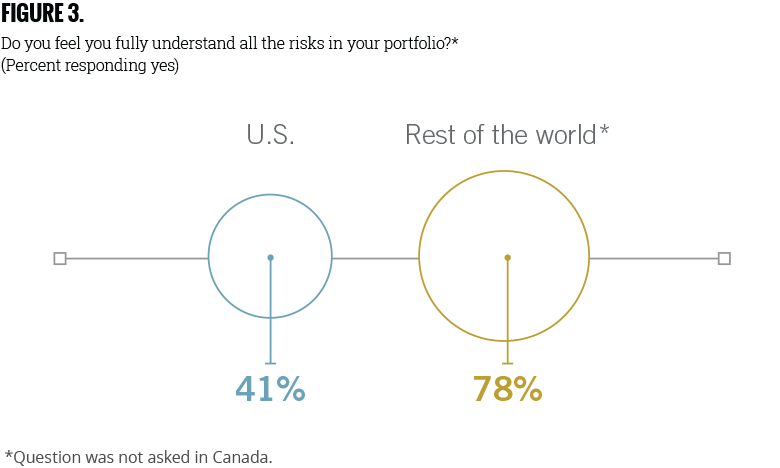

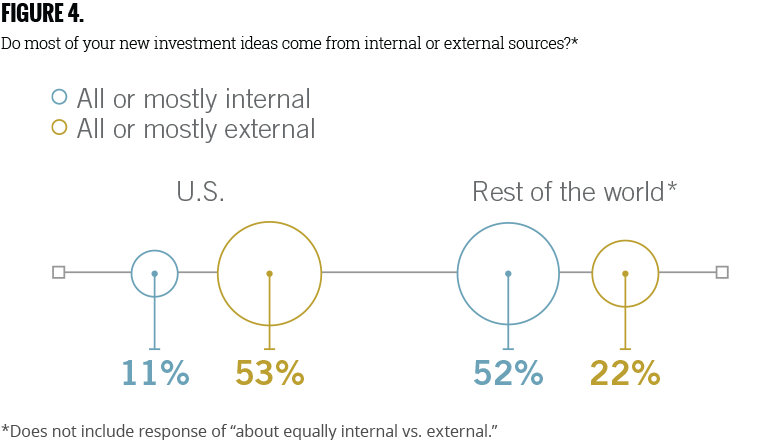

However, there are also areas of disconnect that bear watching. The complexity of institutional portfolios—specifically when it comes to alternative investments—appears to have exceeded investor knowledge and comfort levels. A majority of respondents, both public and corporate, report that they do not fully understand all the risks in their portfolios, even as some public plan sponsors expect to move more assets into alternatives. Alternatives, such as hedge funds and private equity, are complicated and carry unique risks, and many investment committee and board members must rely on outside resources (e.g., consultants) to fully understand the risks to the plan. The U.S. reliance on outsourced investment expertise stands in sharp relief to the rest of the world, where pension schemes leverage in-house investment professionals as their primary source of investment innovation. “Today, some investors appear to be less comfortable with the risks, complexities, and costs associated with their alternatives allocation,” notes Pam Holding, chief investment officer for Pyramis Global Advisors. “While investors may appreciate the diversification benefits alternatives can provide, others are beginning to question their value relative to the fees charged,” she continues.

“Today, some investors appear to be less comfortable with the risks, complexities, and costs associated with their alternatives allocation. While investors may appreciate the diversification benefits alternatives can provide, some are beginning to question their value relative to the fees charged.”

U.S. Corporate Pensions

Goals and Objectives

Confidence abounds

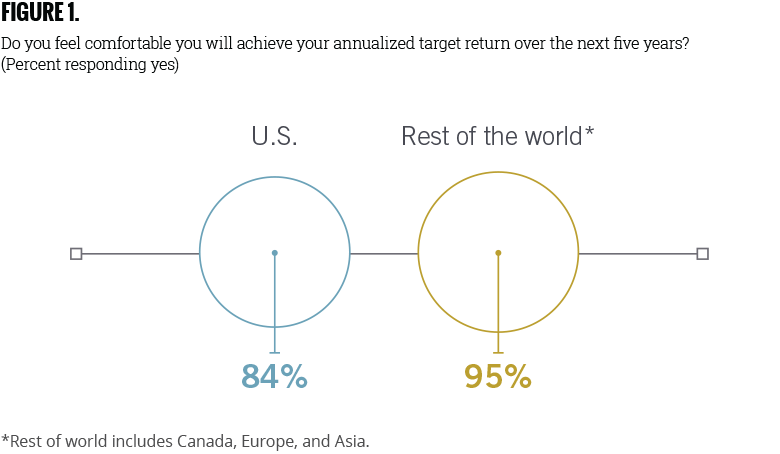

U.S. pension executives have had fair investment winds at their backs for several years now, and it shows. Eighty-four percent of U.S. respondents say they are comfortable they will achieve their return targets over the next five years, up from 71% in 2012. So what is keeping today’s pension investment officer up at night? In the U.S., institutions are most concerned about their funded status. It was the top concern for 28% of respondents, followed by risk management at 20%.

While U.S. corporate plan sponsors may have been hoping for growth in 2012, by 2014 it became their top objective. More than one-third of respondents said their primary investment objective has changed over the last five years, and for most that meant a move away from capital growth to funded status growth. Accordingly, both capital growth and capital preservation lagged in this year’s priority list, with 21% and 11% of respondents, respectively, choosing these as their top priorities.

Outsourcing investment innovation

We may be at a point where asset allocation has outpaced education. Only 41% of U.S. pension fund executives feel they fully understand all the risks in their portfolio. As investments and strategies have grown more complex, U.S. corporate investment committees have come to rely more on outside investment expertise to help them design and implement their investment strategy. When we asked pension investment executives where most of their new investment ideas came from, 53% said “all or mostly external” sources. “In the U.S., we see a trend towards outsourcing and unconstraining, while in other parts of the world our data suggest a move towards more in-sourcing and constraining as a way to manage risk and improve returns.” Holding observes.

To understand more about why this is so, we asked how pension investment committees spend the majority of their time. As one might expect, manager monitoring and evaluation was the top time consumer for one-third of survey respondents, followed by discussing and managing risk exposure (30%); discussing current and target asset allocation (19%); and other activities (12%). While these functions are all worthy endeavors for plan fiduciaries and staff charged with setting and monitoring the overall investment direction of the pension plan, they leave little time to keep up with industry innovations and the latest thinking in investment strategy. Only 6% of survey respondents said they spend the majority of their time researching and understanding new investment ideas.

In past surveys, committee investment education was often cited as an area plan sponsors would like to improve, but it seems that many do not yet have the time or the resources to do so. It is no wonder, then, that most U.S. pension plans rely on external sources for investment insight—a trend that is in stark contrast to their European and Asian counterparts, the majority of whom generate most of their investment ideas in-house.

U.S. PUBLIC PENSIONS

Goals and Objectives

Favorable markets breed confidence

Public pension executives, too, have enjoyed a favorable—if unexpected—investment climate for several years now. Buoyed by these fair winds, eighty percent are confident they will achieve their return targets over the next five years, up from seventy-one percent in 2012.

In 2014, most public pension executives are focused on improving their plan’s funded status. With underfunded plans and little cash to contribute, growth is paramount for public plans—62% cited “funded status growth/improvement” as their top investment objective. Twenty percent are still focusing on capital growth, and 18% are concerned about preserving their funded status.

Most public pension executives have a clear vision for their pension plans: They intend to stay open and continue providing benefits for new and existing employees. Facing serious underfunding, and with no ready cash available, public pension investment officers are focused on growing and improving their funded status. After 2008 and its bleak market outlook, and encouraged by the early success of some bellwether institutions, the public pension sector moved heavily into alternatives as a way to advance growth. This trend continues today and, despite discomfort with the risks and costs of hedge funds and private equity, public plan sponsors expect to allocate even more to alternatives over the next few years in order to meet fast-approaching liability obligations.

Summary

After several years of favorable market conditions, corporate and public pension officers are optimistic about their ability to realize their five-year return targets. Funded status growth has replaced concern over returns and volatility. U.S. pension executives have hit the pause button on de-risking and hope to ride the fair investment winds a bit longer. And while most have identified their desired end state for their plan, nearly one in four are still discussing what to do with their pensions. Strapped for resources and time, key decision-makers are looking to external sources to provide investment ideas.

Perhaps as a result of this reliance on outsourcing, the U.S. pension community follows accepted industry investment norms and mainstream asset allocation trends as they work toward their objectives.

But while tried and true ideas are a useful starting point, each investment decision should be considered in the context of an organization’s time horizon, expertise and comfort level. Many plan sponsors admit they do not fully understand all the risks in their portfolio. Every institution is unique, and following conventional wisdom may not be suitable for everyone. There is real value in periodically revisiting, and questioning, investment objectives, risk tolerances and portfolio construction. There are signs that this is starting to happen.

For more information on the 2014 Pyramis Global Advisors Institutional Investor Survey, please visit www.pyramis.com/survey.

Asset International, Inc., and the Financial Times are third-party vendors that Pyramis has hired to collect responses to the survey. Pyramis, Asset International, Inc., and the Financial Times are independent entities and are not legally affiliated.

Past performance is no guarantee of future results.

Indexes are unmanaged. It is not possible to invest directly in an index.

Important Information: Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any securities.

Index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, and other expenses, which would reduce performance.

Certain data and other information in this survey were supplied by outside sources and are believed to be reliable as of the date presented. However, Pyramis has not verified and cannot verify the accuracy of such information. The information contained herein is subject to change without notice. Pyramis does not provide legal or tax advice, and you are encouraged to consult your own lawyer, accountant, or other advisor before making any financial decision.

These materials contain statements that are “forward-looking statements,” which are based upon certain assumptions of future events. Actual events are difficult to predict and may differ from those assumed. There can be no assurance that forward-looking statements will materialize or that actual returns or results will not be materially different than those presented.

All trademarks or service marks presented herein belong to FMR LLC or an affiliate, except for third-party trademarks and service marks, which belong to their respective owners.

For Institutional Use Only

701935.1.0

© 2014 FMR LLC. All rights reserved.