For more stories like this, sign up for the PLANSPONSOR NEWSDash daily newsletter.

Does the Barclays Agg Still Make Sense for Target Date Funds?

Does the Barclays Agg Still Make Sense for Target Date Funds? TDFs Consider the Barclays U.S. Aggregate Index TDFs Consider the Barclays U.S. Aggregate Index No BlackRock 2016-06-30 Rising rates, challenging credit spreads, and constricted bond

Rising rates, challenging credit spreads, and constricted bond inventory: The world of fixed income isn’t changing—it’s already changed. Recently, target date fund managers have joined the conversation about whether the Barclays U.S. Aggregate Index (“the Agg”) remains an appropriate benchmark for their bond exposure.

Many plan sponsors we’ve spoken to have begun to explore substituting part or all of the Agg exposure with other asset classes, including global, high-yield or long duration bonds. Yet as we describe below, BlackRock’s analysis suggests that these changes offer either minimal or no benefit for most target date funds. To understand why, we need to begin with a firm understanding of the roles the fixed income allocation is expected to play.

Exploring Alternatives

Target date funds are designed to provide an appropriate asset allocation for each stage of a participant’s career, up to and including retirement. The fixed income allocation is one of the key tools for helping to achieve that objective, playing three major roles, including acting as a:

Risk Lever: Because fixed income generally has lower risk than equities, a fund manager can adjust portfolio risk by shifting allocations between equities and fixed income.

Shock Absorber: Historically, bond and stock returns have a low correlation. This gives bonds the potential to cushion equity shocks, which is particularly important closer to the target date when participants are more likely to overreact to market shocks.

Return Source: Finally, bonds have return potential through yield or price appreciation, making them generally a more attractive risk management tool than cash.

For standalone bond funds, many plan sponsors have been focused on reducing interest rate risk. Within a target date fund, reducing interest rate risk may increase the allocation’s return potential, but it may reduce its diversification potential. Once we review the tradeoffs, we believe the changes do not show a strong enough net gain at the fund level to justify their implementation. Let’s review the three possibilities in turn:

Global Bonds: The argument for replacing all or part of the domestic bond allocation with global bonds is that it may increase diversification through lower correlations with other asset classes. Even if that is the case, global bonds introduce currency risk— in fact, over half of the total risk in the Barclays Global Aggregate Index during the last 10 years can be attributed to currency risk.*

In the short-term, currency can be very volatile. But in the long term, the expected return from currency risk is generally zero. In other words, there is likely to be no compensation for carrying the short term risk. The risk may be managed through currency hedging, but the additional expense of currency hedging may be a drag on returns.

Hedged or unhedged, the question is whether global bonds, in any form, improve the outcome. Table 1 presents historical risk and return for three portfolios with a 50% allocation to the S&P 500 Index and varying bond exposures. The hedged exposure provided only a negligible difference in returns and no difference on a risk-adjusted basis. The cumulative returns for these approaches presented in the chart tell a similar story.

The bottom line: We believe that global bonds marginally increase diversification, decrease the ability to control risk (unless we hedge) and have over the past decade offered limited return advantage. At best it is a wash, and when we consider other issues, such as transaction and hedging costs, the positive case for global bonds is hard to make.

High Yield: Replacing a portion of the fixed income allocation with high yield bonds increases exposure to credit spreads, thereby increasing return potential. However, with high yield’s return potential is greater expected risk, which will reduce the portfolio manager’s ability to adjust portfolio risk. Higher yield also has a higher correlation to equities, so it would also tend to reduce its ability to absorb equity shocks.

In Table 2, we compare the historical risk and return for a model portfolio 50% invested in the Agg with one in which 10% of the fixed income exposure has been re-allocated to high yield. We see that may have improved returns slightly, but at the expense of a higher risk and a diminished risk-adjusted return.

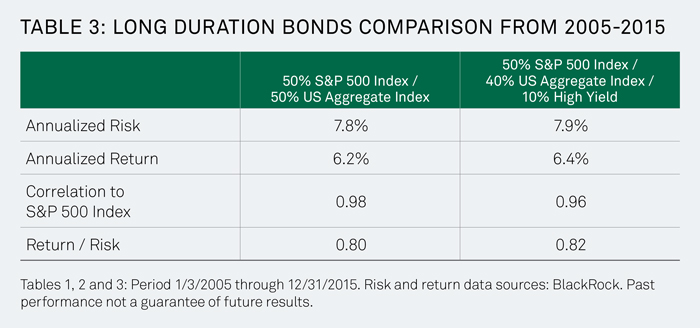

Long Duration: If we replace 10% of the fixed income allocation with long duration bonds (see Table 3), we find some improvement in risk and return potential. But is it enough to add an asset class to a fund? Our preference is for simplicity. Complexity increases operational risk, which is an important risk for a fiduciary to manage. We do not believe that at this point there is a strong enough case for adding long duration bonds to justify increasing operational complexity.

Risk and the Fixed Income Allocation

Rising interest rates have increased concerns about the return potential of standalone bond funds pegged to the Barclays U.S. Aggregate Index. But how significant is the fixed income risk within a target date fund?

The reality is that because equities have much higher risk than fixed income, even a relatively small exposure to equities will dominate the risk profile of a fund. This holds true even in funds at or near their target date, where the fixed income allocation may be anywhere from 50% to 80% of the portfolio.

Consider an allocation that is 50% bonds and 50% equities. Yet, according to BlackRock’s analysis, only 6% of the overall portfolio risk is derived from the bond allocation. Furthermore, using BlackRock’s Aladdin risk analytics, we can drill down into the sources of risk and find that, as of February 2016, less than 1% of the overall portfolio’s risk is due to interest rates alone. It’s useful to keep this in mind when weighing proposed changes to the fixed income exposure.

Fixed Income’s Role

We want the case for including an asset class in a target date fund to be clear and have the potential to meaningfully improve participant outcomes. It should appeal to theory, history and expectation. The alternative bond allocations we’ve reviewed here do not, in our view, improve that outlook materially, or do so in a negligible way.

But while we can still get diversification and risk control from fixed income exposure tied to the Agg, BlackRock expects the Agg to deliver lower returns than in the past. How can we make the fixed income allocation more meaningful to the investment outcome?

For a plan sponsor willing to consider additional alternatives, there are strategies worth considering.

For example, one approach is allocating to opportunistic fixed income funds. These are active funds that seek to maintain little-to-no interest rate exposure while seeking to add return through a variety of strategies including sector allocation, security selection and duration selection. We feel they may be additive in target date funds with active components and we include them in our own active offerings.

For many plan sponsors, however, a bias toward simplicity makes sense. As demonstrated here, continuing to allocate target date fund capital to fixed income funds based on the Barclays U.S. Aggregate Index remains an appropriate choice.

DCFOCUS

Published by BlackRock, Inc.

Find DCFOCUS on the web at blackrock.com/dc

To subscribe, visit blackrock.com/subscribe/dcfocus

*Source: BlackRock

Investing involves risk, including possible loss of principal.

Asset allocation models and diversification do not promise any level of performance or guarantee against loss of principal. The target date in the name of the fund designates the approximate year in which an investor plans to start withdrawing money. Typically, the strategic asset mix in each portfolio systematically rebalances at varying intervals and becomes more conservative (less equity exposure) over time as investors move closer to the target date. Investment in the funds is subject to the risks of the underlying funds. The principal value of a target date fund is not guaranteed at any time, including at and after the target date.

BlackRock is not affiliated with any of the third party entities mentioned in this material.

The opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non- proprietary sources deemed by BlackRock, Inc. and/or its subsidiaries (together, “BlackRock”) to be reliable. No representation is made that this information is accurate or complete.

There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material does not constitute a recommendation by BlackRock, or an offer to sell, or a solicitation of any offer to buy or sell any securities, product or service. The information is not intended to provide investment advice. BlackRock does not guarantee the suitability or potential value of any particular investment.

In Canada, this material is intended for accredited investors only. This material is provided for informational purposes only and does not constitute a solicitation or offering of shares or units of any fund or other security in any jurisdiction in which such solicitation or offering is unlawful or to any person to whom it is unlawful.

In Latin America, for Institutional and Professional Investors Only (not for public distribution). This material is solely for educational purposes only and does not constitute an offer or a solicitation to sell or a solicitation of an offer to buy any shares of any fund (nor shall any such shares be offered or sold to any person) in any jurisdiction within Latin America in which an offer, solicitation, purchase or sale would be unlawful under the securities law of that jurisdiction. If any funds are mentioned or inferred to in this material, it is possible that some or all of the funds have not been registered with the securities regulator of Brazil, Chile, Colombia, Mexico, Peru, Uruguay or any other securities regulator in any Latin American country, and thus, might not be publicly offered within any such country. The securities regulators of such countries have not confirmed the accuracy of any information contained herein. No information discussed herein can be provided to the general public in Latin America.

Material prepared by BlackRock Institutional Trust Company, N.A., located at 400 Howard Street, San Francisco, CA.

©2016 BlackRock, Inc. All rights reserved. BLACKROCK and LIFEPATH are registered and unregistered trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

168698T-DC-A-0316 / DCM-0308

Lit. No. DCF-BARCLAY-0316

FOR INSTITUTIONAL USE ONLY—NOT FOR PUBLIC DISTRIBUTION